Accounts payable (AP) automation streamlines and automates the process of capturing, matching or approving, and paying supplier invoices.

AP Automation:

- involves digitizing invoice data, automating workflows, and eliminating manual tasks.

- reduces accounts payable costs, speeds up approvals, and provides visibility into AP processes.

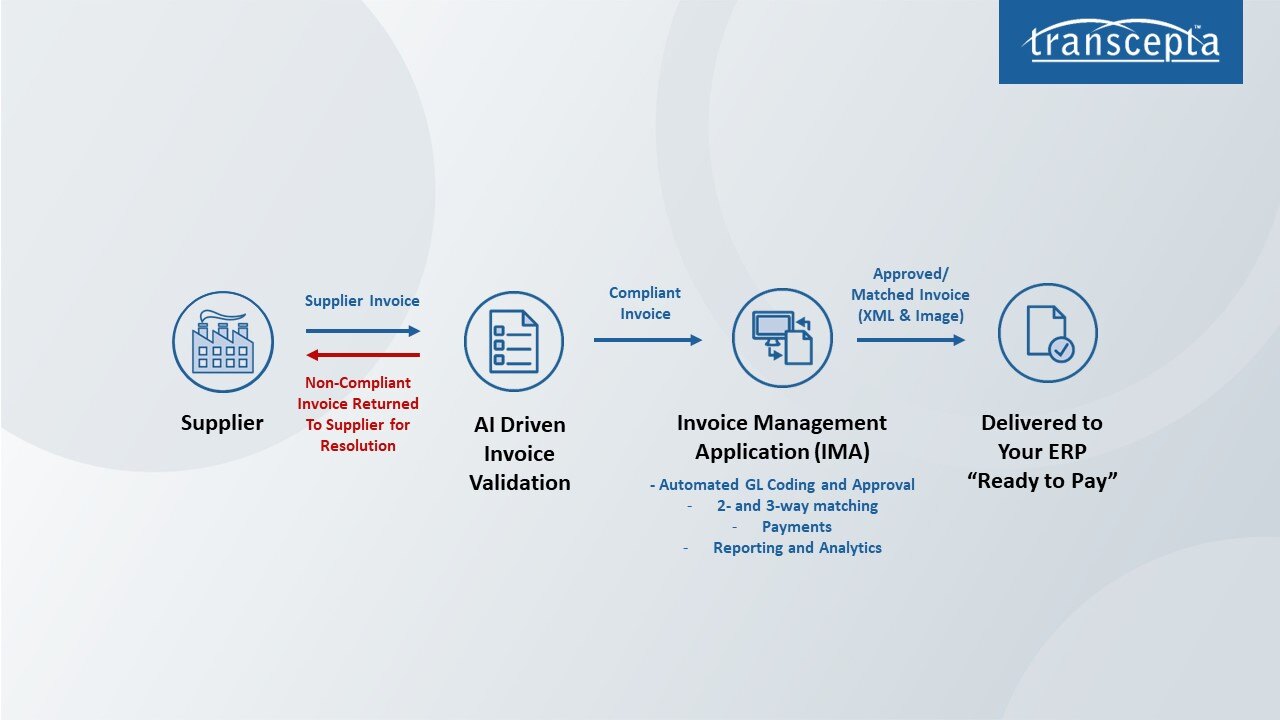

How AP Automation Works

- Invoice Capture: Converts invoices into a standardized digital format.

In the early days of AP automation, OCR played a key role in converting invoice images to digital formats. OCR worked well with standardized documents, but among other frustrations, handling variations in formats and layouts were a headache. AP teams needed to continuously verify “read errors” and update “OCR maps.”

Today, the best platforms use Digital Supplier Networks, which process invoices digitally. The result is100% accurate invoice capture and no need for manual invoice reviews. - Invoice Matching: Automatically matches invoices with purchase orders and delivery receipts to ensure accuracy.

AP automation verifies accuracy and validity of a PO associated with an invoice. If there is, AP automation will perform either a two-way match to ensure the PO and invoice match, or a three-way match to check the PO, invoice, and delivery receipt. - General Ledger (GL) Coding: Automatically assigns the correct GL codes to invoices.

Invoices that require GL coding also require human intervention.

However, with the best AP automation platforms, AI automates the GL coding process. Every invoice feeds the platform more data to improve coding success probabilities, so AP staff does not need to enter GL codes manually. - Approval Workflows: Routes the invoice for approval.

AP automation sends the invoice for approval commonly based on the organizational structure, budget authority, and predefined approval limits. The best platforms can accommodate whatever business rules the organization has or desires. Additionally, the entire process should be tracked and reportable at any point in the process. - Payment Processing: Automates the payment of approved invoices to suppliers.

Once an invoice has been validated and approved, AP automation software will trigger an automatic payment. The best platforms have detailed remittance data and offer wide variety of payment options, including virtual cards, ACH, and check. - Reporting and Analytics: Provides insights into AP performance, and the insights you need to make data-driven decisions and optimize your business.

The best AP automation platforms provide visibility into every aspect of your supply chain enabling you to identify potential disruptions, make better supplier and payment decisions, and accurately forecast liability and cash flow. Get the insights you need to make data-driven decisions and optimize your business.

Benefits of AP Automation

By automating AP processes, AP leaders will reduce errors, speed up invoice processing, and improve overall efficiency in managing accounts payable.

But the benefits of AP automation extend beyond just efficiency gains and eliminating invoice exceptions. To learn more:

- Watch 2-minute video to learn about the AP Automation benefits.

- Watch 3-minute video to learn how Raytheon moved to a 100% digital AP department.

- Watch our webinar to learn how FleetPride automated accounts payable and cut costs by millions.

With Transcepta AP Automation things run smoother, costs stay under control, and AP Departments are liberated and ready to take on whatever comes their way. Are you in?

Subscribe to newsletter

Subscribe to receive the latest blog posts to your inbox every week.

By subscribing you agree to with our Privacy Policy.